The opportunity of the energy transition

The global imperative to reduce greenhouse gas emissions and address their impact on climate change is clear.

What is the size of the opportunity?

The global imperative to reduce greenhouse gas emissions and address the effect these have in climate change is clear. Particularly since the UN COP21 in Paris in 2015, governments and companies alike have increasingly committed to reducing their emissions, and many of them, to achieve net zero emissions around mid-century. As these commitments take shape and pledges convert to action, unprecedented volumes of capital in investments are expected with the goal of decarbonizing entire industries, from industrial and manufacturing sectors to transportation and agriculture. This capital deployment presents a significant opportunity.

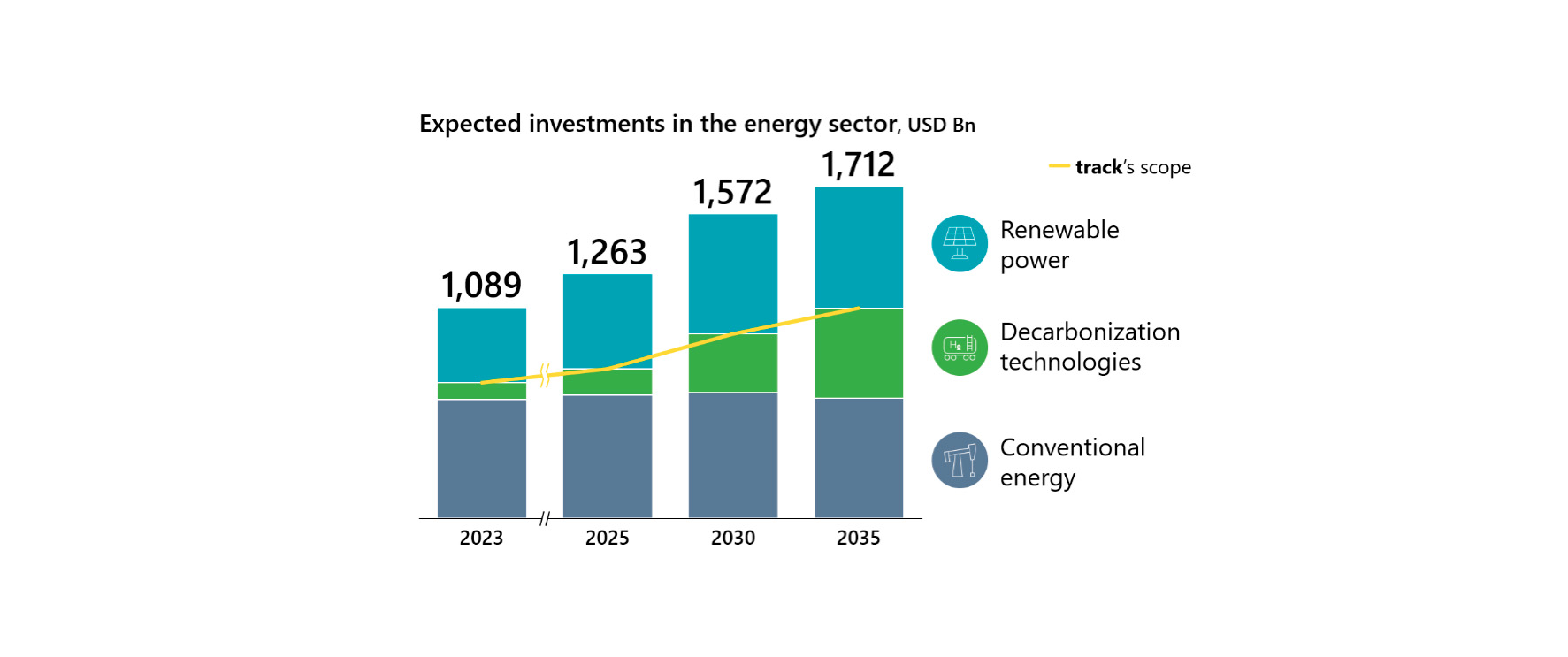

In terms of overall investment, the energy sector is expected to grow +55% by 2035, reaching over $1.7 Tn per year, as new technologies and related infrastructure are deployed.

However, certain segments of the energy sectors are expected to have different evolutions. On the one hand, investment in conventional energy is expected to remain relatively stable in the period. On the other hand, the renewable energy segment, including solar, onshore and offshore wind, amongst others, is expected to see investments grow over 60% in the same period. Last, investment in decarbonization technologies, which include green and blue hydrogen, biofuels and e-fuels, and carbon dioxide capture, use and sequestration, is expected to grow almost over 5x, to roughly $460 Bn by 2035. This segment represents 60% of the growth in total energy investments and is a key enabler of the decarbonization of the global economy.

Aside of the energy sector, other industrial sectors will also deploy significant volumes of capital to decarbonize. For example, the steel production sector, responsible for roughly ~8% of global carbon dioxide emissions, is expected to invest over $160 Bn per year between 2030 and 2040, as it replaces its high-emitting blast furnaces for electric arc furnaces with clean hydrogen as a reduction agent, amongst other measures. Moreover, the cement sector, whose clinker production process drives the majority of the sector emissions (which make up ~7% of global carbon dioxide emissions) will also see significant investment. Approximately $70 Bn per year are expected to be invested in the sector, with carbon capture as the technology expected to reduce up to two thirds of the sector emissions by 2050.